Mar 31, 2021

by Jessica Saayman

Blockchain, Bitcoin, Ethereum, Ripple, Dogecoin, Altcoin - do not be mistaken, these are not terms associated with the enchantments cast in the games of Minecraft or Dungeons and Dragons, these terms have formed their own market in our worldwide economy, and since has progressed into an absolute exclusive currency-system and untouchable digital bazaar.

In 2009 the first Bitcoin was released by “Satoshi Nakamoto” a pseudonym allegedly belonging to Craig Wright who claims to be the enigmatic inventor. Whilst investors have put varying faith in the decentralized currency, the economies of the world experienced its first taste of Blockchain technology. Although Blockchain was initially demarcated in 1991 by Stuart Haber and W. Scott Stornetta, two researchers who wanted to realize a system where record timestamps could not be tampered with using a cryptographically secured chain of blocks, it was not until two decades later that in 2008 the release of the white paper establishing the model for a blockchain was released by the elusive inventor Satoshi Nakamoto who widened its application.

Blockchain, in short, is an explicitly specific database which “builds” on data, rather than how an archetypal database would store information in an encrypted form with a comprehensive order and a filtering system with the basis of an eject and erase dependable. It picks up data and stores it in “blocks”, subsequently each block of data is chained to the next – which essentially means that the data is unparalleled, uncontrolled by any one person, and unerasable because each is bonded to another – such as the structure of DNA. It is an infinite and permanent ledger of any and all cryptocurrency transactions, making it the most detailed and transparent database known to technology. Further, in 2014, the Blockchain technology separated itself from the currency and the potential for other financial interorganizational transactions began its exploration, leading up to the Ethereum system. The Ethereum blockchain system introduced computer programs which represented financial instruments such as bonds, this became coined as “smart contracts” which allows buyers and sellers to form an agreement of sale in the form of computer code, without the need for a third party.

Cryptocurrencies, although known worldwide, is not accepted everywhere, whilst it has been accepted as a means of payment in the Swiss Cantons or The Isle of Man. These currencies are almost completely unregulated because they were not created by our governments or leaders and created as an electronic cash system that is fully peer-to-peer, without the need for a trusted third party meaning that cryptocurrencies have intrinsic value because of the level of security that comes with the Blockchains permanence. Unfortunately for reluctant governments, crypto’s are designed to reign freely and in full transparency, meaning the investors draw to the up-and-coming currency is not one that can be centralized or hindered.

Governments of countries such as Israel, Bulgaria, Denmark, and the USA have added certain tax restraints on the decentralized currencies as a means to begin the development of regulating the market. In the USA, for example, crypto is taxed based on the 2014 IRS ruling that determined that cryptocurrency should be treated as a capital asset such as stocks or bonds rather than a currency such as Dollars or Euros. The ramifications of such are that the cryptocurrency is taxed whenever it is “sold” at a profit – meaning if you may have bought $10 worth of Bitcoin and held it as it rose in value to $1,000, you are taxed on the $990 profit realized when you spend it on i.e., buying a new computer, rather than the IRS recognizing that it has been spent, it taxes it as if it has been sold, making for a complicated equation for profiteering.

Coming to the United Arab Emirates (“UAE”), a region with an impressive $414.2 billion GDP, a population of 9.6 million and one of the most economically stable countries in the world, which aims to beat every race it pledges itself in, the UAE is not averted to embracing the crypto market and perhaps may set the bounds for winning at it. Notwithstanding, however, under Article D7.3 “Provisions of Virtual Currencies” of the Regulatory Framework for Stored Values and an Electronic Payment System as issued by the Central Bank of the UAE in January 2017, transactions in “virtual currencies” which encompass the traits of cryptocurrencies are strictly prohibited . Further to this, in 2018 Mubarak Rashid Al-Mansouri, the then-current governor of UAE Central Bank further reiterated that these currencies are susceptible to use in money laundering or terrorism funding.

Basis the 2017 Regulatory Framework, the Central Bank of UAE is not wrong in underlining that such unregulated and uncertain platforms of trade for virtual currencies that are intangible opens the doors to elicit crimes. Whilst money laundering is one of the main concerns on a global scale, the UAE prides itself on its ability to source out criminal activity and tackle the same with vigor. With the crypto buzz, the most common belief is that cryptocurrencies provide criminal organizations with a new means of committing fraud and a host of other financial crimes. Though this may not directly impact most crypto investors who do not take part in such criminal activity, some investors find themselves in the unfortunate position of being a victim of financial crime and due to the lack of substantial regulatory framework and legal development in the field, they do not share the same legal solutions as traditional victims of fraud. This is one key reason why some governments across the world choose not to facilitate the exchange despite the ever-growing technology of encrypted crypto wallets designed with the most advanced and intelligent security measures.

Currently, almost four years from the release of the Central Bank’s framework, on March 10th of 2021, the UAE took part in the World Government Summit Dialogues where Brock Pierce- the founder of Blockchain Capital said that governments should come on board in shaping the regulatory environment for digital currencies. He noted: “What’s imperative is that we make sensible decisions when we are passing regulations, because the world is changing, and we don’t want to be left behind because of a decision made in haste2”. It is noteworthy that many billionaires across the world such as The Winklevoss Twins- founders of the crypto exchange “Gemini”, Skype and Tesla investor Tim Draper and founder and CEO of Binance

Changpeng Zhao came into the greatest wealth because they chose to participate in the new financial era and continue to encourage the same from other high-profile investors.

Furthermore, the Summit emphasized that governments must seek to embrace the new currencies and educate the people about them to ensure that the country does not hinder its own growth due to ignorance and inflexibility to change. Crypto and blockchain technologies have developed at an alarming rate since its breakthrough in 2009- such as the rabbit hole of Artificial Intelligence, cryptocurrency is another Alice chasing the white rabbit in wonderland – in other words, a world with no bounds. The fear for the most part is with all these changing technologies coming to light, we, as human nature has beset it, do not like change. With shifting technologies, currencies, and markets, there is the changing of the economy, trade, and possibly, job security.

With those doubts in mind, consider the recent advancements in the UAE, specifically, as of the 23rd of February 2021, Arabian Bourse (“ABX”) has been named to be an Abu Dhabi Global Market (“ADGM”) based, fully regulated, crypto-asset Margin Trading Facility and custodian targeting global institutional and retail traders. Ultimately, the vision of ABX is to protect investor interests in cryptocurrencies by ensuring that the market is not misused in any way by persons committing forms of financial crimes or violations from any country. With ADGM’S high anti-money laundering standards it may just become a lead in developing investor interests in the cryptocurrency market, in the Gulf.

The UAE has further opened its doors to the crypto world by the means of the Memorandum of Understanding entered into by and between the Dubai Multi Commodities Centre (“DMCC”) and the Securities and Commodities Authority (“SCA”) in which the agreement will see businesses dealing with crypto assets gain access to bespoke licenses offered by the DMCC “Crypto Centre” as a means to work together and establish a regulatory framework for businesses offering, issuing, listing, and trading crypto assets within the DMCC.

In summary, providers who wish to offer crypto assets or related services must either be incorporated onshore or within the Dubai International Financial Center (DIFC), DMCC, or ADGM and must be licensed by the SCA to do so. Applicants should be able to demonstrate strict compliance with the UAE’s anti-money laundering and counter-terrorist financial laws, cyber security compliance standards and data protection regulations.

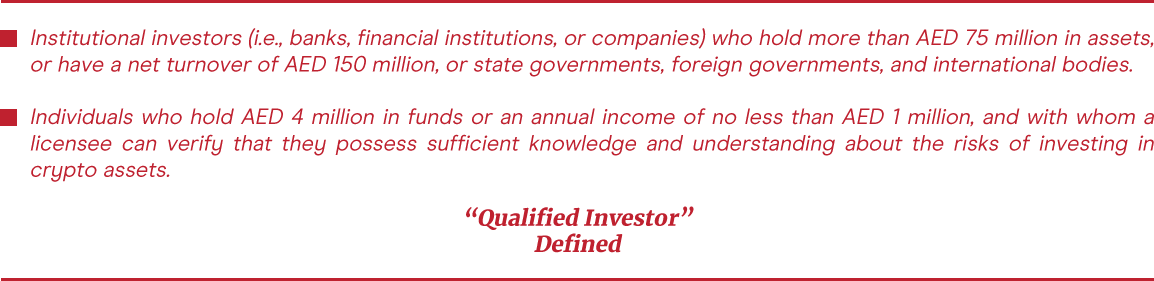

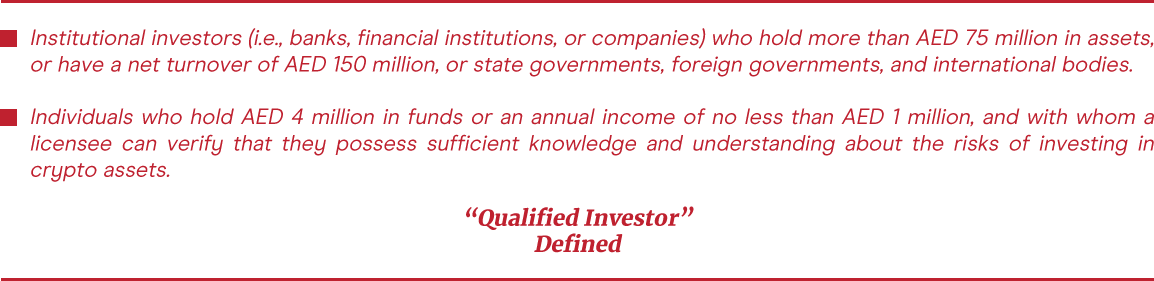

Further, under “The Authority’s Chairman of the Board of Directors Decision No. (21/R.M) of 2020 Concerning the Regulation of Crypto Assets” (“SCA Decision”) cryptocurrency can be offered to either a “Qualified Investor” or non-qualified investor as defined below:

With this definition, it forces providers to seek approval from SCA in the evaluation of a suitable investor, further ensuring that they are experiencing less risk at the hands of financial crimes that may take place because of the volatile financial territory.

Conclusively, the “crypto game” is a risky one, such as with any other commodity in trading, the inherent loss may be brutal, but that does not mean every trade is bound to result in the same consequence. Whilst many investors have filled their virtual pockets with currencies such as Bitcoin, Ethereum, Litecoin, Ripple and so on, not every investor is lucky enough to walk away with such a win. With money laundering and terrorist financing activities taking a toll on trading platforms on the blockchain, it is uncertain how governments can affect the blockchain system to ensure that such crimes do not go undetected. However, with an embracing attitude towards these virtual currencies, the ignorance of the same can be reduced, thus allowing countries such as the UAE in its bid to expand, develop, and to apply preventative measures to such interactions through legal developments. Rather than taxing the currency, the UAE has decided to develop the legal field of the Blockchain technology for the benefit of preventing crime, as in some means, the UAE understands that standing idle with the changing tides, will be the same as facilitating the crime.

CMI is a Legal Consultancy licensed by the Abu Dhabi Global Market and maintains an expertise in financial and capital markets including assistance and consultancy for entities seeking to obtain digital securities or virtual assets license approvals from the FSRA or SCA.

Disclaimer: Century Maxim International (“CMI”) is a Company incorporated in UAE. This is an informational document and should not be construed as a recommendation of any format.

This document contains certain key points of legal structures as implemented/applicable in a particular jurisdiction. No information as given herein by CMI should be construed as an advise or recommendation or solicitation, nor should it be considered as a legal, regulatory, credit, tax or accounting advice.

At CMI, the team is focused in providing legal solutions with a research and strategy-based approach, thus no content of this nature in its current format must be read as a problem or deemed as a solution. CMI undertakes responsibility only when a formal engagement with the Client has been formalized between the parties involved under the terms agreed thereby.